Wednesday 4th March 2026

Weekly Market Update

Overview

Last week, global markets were mixed as investors navigated a combination of geopolitical tensions, economic data, and corporate earnings. In the U.S., stocks fell on worries about AI disruption and trade uncertainties, while Treasuries gained as yields fell below 4%. Europe saw moderate gains, supported by strong corporate earnings and improving German business confidence, though France remained cautious, and UK markets rose on hopes of future rate cuts. Japan’s markets hit record highs amid optimism on policy direction, despite a slightly weaker yen and mixed economic signals. In emerging markets, China’s markets rebounded after the Lunar New Year, supported by relaxed property rules and stable yuan policy, while Indian equities softened with sectoral divergences. MENA markets were volatile, with Gulf equities falling amid rising regional tensions and UAE exchanges briefly closing, pushing oil prices higher and boosting safe-haven assets. Commodities saw sharp swings, with oil and gold rallying on supply and geopolitical concerns, while currency markets reflected a flight to safety, with the U.S. dollar, yen, and Swiss franc strengthening and risk-sensitive and emerging-market currencies weakening. Overall, last week was marked by caution, risk aversion, and selective gains across regions and sectors.

The Week Ahead

Wed: US Crude Oil Inventories – Weekly data showing changes in U.S. oil stockpiles, which can influence oil prices and energy markets.

Thu: US Initial Jobless Claims – High-frequency measure of labor market strength; rising claims indicate weakening employment conditions.

Fri: US Unemployment Rate (Feb) – Percentage of the labor force unemployed and actively seeking work, reflecting overall labor market health.

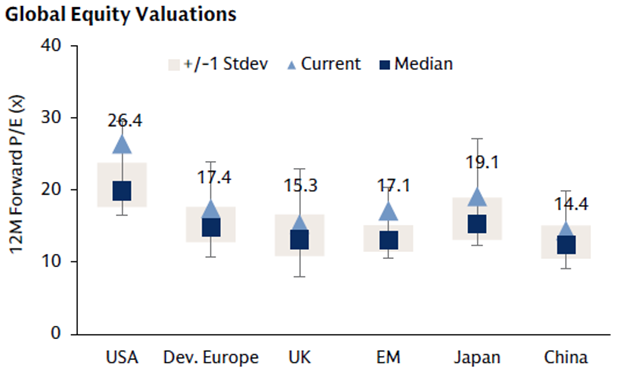

Outlook: As we move into 2026, the tug-of-war between global growth and inflation has moderated, allowing central banks greater flexibility to shift from restrictive policy toward gradual easing. While the pace of rate cuts is likely to be measured, monetary conditions are becoming more supportive for risk assets. We continue to favour equities, with a focus on high-quality, profitable, blue-chip companies that exhibit strong balance sheets, durable earnings and healthy free-cash-flow generation. Fixed income remains an important portfolio anchor, with yields still attractive by historical standards and offering income and diversification benefits without excessive duration risk. Beyond developed markets, emerging market equities and smaller companies continue to trade at compelling valuation discounts relative to US large-cap peers, presenting selective opportunities for long-term investors. Overall, the outlook for equities in 2026 remains cautiously constructive, supported by easing financial conditions, resilient corporate fundamentals and improving global liquidity, while acknowledging that geopolitical risks, fiscal dynamics and sector-level dispersion will remain key factors to monitor.

Asset class forecasts*

Developed Markets

North America

Last week, U.S. stock markets declined as investors grew increasingly cautious about the disruptive impact of artificial intelligence and ongoing global trade and tariff uncertainty. The Dow Jones posted the largest drop, while the S&P 500 fell more modestly, reflecting a broadly risk-off tone. Early in the week, sentiment weakened following a widely circulated AI-related research report, and although NVIDIA delivered stronger-than-expected earnings, it was not enough to reverse the negative momentum. On the economic front, wholesale inflation rose more than expected, driven mainly by a sharp increase in services prices, while factory orders contracted due to weaker commercial aircraft demand. Consumer confidence edged higher but remains well below recent peaks, and jobless claims were broadly stable, suggesting a still-resilient labour market. Meanwhile, declining equity markets supported U.S. Treasuries, pushing yields lower, with the 10-year yield dipping below 4%, while investment-grade and high-yield corporate bond performance remained mixed.

Europe & UK

Last week, European markets moved higher, with the STOXX Europe 600 Index reaching a new high and gaining 0.52% in local currency terms, supported by robust corporate earnings and investors increasingly diversifying away from the technology-heavy U.S. market despite ongoing geopolitical tensions and renewed trade tariff uncertainty. Major indexes posted solid gains, particularly in Italy and the UK, with the FTSE 100 touching a fresh high midweek, while Germany and France also recorded moderate advances. In Germany, business confidence improved for a second consecutive month, reflecting stronger sentiment among manufacturers and service providers and signaling cautious optimism about economic momentum. In contrast, France’s business confidence slipped, highlighting lingering concerns about the pace of recovery, particularly in the manufacturing sector. Inflation data across the eurozone presented a mixed picture, with price pressures easing in Germany, rising slightly in Spain, and remaining relatively contained in France. In the UK, expectations of additional interest rate cuts in 2026 and reassurance over trade relations helped offset tariff-related concerns, supporting overall investor sentiment.

Japan

Last week, Japan’s stock markets rose sharply, with the Nikkei 225 gaining 3.56% and the broader TOPIX up 3.42%, reaching record highs as investors stayed optimistic about the policy direction under Prime Minister Sanae Takaichi. Markets largely shrugged off the latest U.S. tariff announcements, with Bank of Japan Governor Kazuo Ueda noting they were unlikely to have a major impact on Japan. The yen weakened slightly to around JPY 156 against the U.S. dollar after the government nominated two dovish economists to the BoJ Policy Board, fueling speculation of a slower approach to interest rate increases. Meanwhile, Tokyo-area core inflation came in slightly above expectations at 1.8% year over year, supporting the BoJ’s cautious tightening path. Japanese 10-year government bond yields rose modestly, retail sales exceeded forecasts, and industrial production was weaker than expected, highlighting mixed economic signals

Emerging Markets

China

Last week, mainland Chinese stock markets rose in an abbreviated trading week, with the CSI 300 Index up 1.08% and the Shanghai Composite gaining 1.98%, as investor sentiment improved following the Lunar New Year break and ahead of the annual “Two Sessions” meetings where key economic targets are set. Hong Kong’s Hang Seng Index also advanced 0.82%. Travel and spending data over the holiday showed mixed signals, with total tourism and trips increasing but per-trip spending dipping slightly, raising questions about the sustainability of consumer demand. In policy developments, Shanghai eased homebuying rules to support the property market, allowing nonresidents to purchase homes sooner and enabling some to buy a second property. Meanwhile, the People’s Bank of China cut the risk reserve requirement for foreign exchange forward trading to zero, aiming to slow the yuan’s rapid appreciation and maintain a stable and balanced exchange rate, after the currency recently hit a near three-year high against the U.S. dollar.

India

Last week, Indian equities ended softer, with the Nifty 50 declining 1.07% to 25,181.15, while the India VIX rose to 13.68, reflecting a mild increase in risk perception. Broader market performance was mixed, as the Nifty Next 50 gained 1.08% and the Midcap 100 slightly outperformed the Small Cap 100, whereas the Microcap 250 underperformed with a 1.96% drop. Sectoral trends were bifurcated: long-duration and growth-oriented pockets faced pressure, while cyclicals and select defensive sectors held up. Major laggards included Nifty IT, down 5.21%, Nifty Realty at –4.54%, and Nifty Media declining 1.14%, alongside modest underperformance in staples and financials. On the upside, metals led gains with Nifty Metal up 3.43%, followed by PSU Banks (+3.42%) and the energy sector (+2.69%), while healthcare, pharma, and autos also posted solid advances.

MENA

Last week, MENA financial markets faced significant volatility and generally weakened, driven largely by escalating geopolitical tensions in the Middle East and concerns about the impact on energy markets and investor confidence. Several Gulf equity markets, including Qatar and Saudi Arabia, softened as risk aversion spread, while the UAE took the rare step of suspending trading on both the Abu Dhabi Securities Exchange and Dubai Financial Market for two days as a precaution amid heightened regional conflict. Oil prices surged sharply—briefly topping multi month highs—boosting safe haven assets like gold but adding pressure on local stocks. Market participants closely monitored developments around the Strait of Hormuz, as any disruption could affect global energy supply and amplify volatility. Investor sentiment remained cautious, with many trimming exposure to equities and credit markets, while seeking safer assets amid uncertainty. Analysts noted that short-term market movements were largely driven by geopolitical risk rather than fundamentals, highlighting the fragility of sentiment in the region.

Commodities and Forex

Commodities

Last week, global commodities markets were dominated by sharp price swings amid heightened geopolitical risks, particularly in the Middle East, which pushed oil prices sharply higher as tensions threatened supply routes and sparked safe haven buying in energy markets. Brent and U.S. crude both climbed strongly on the back of conflict driven supply concerns, with oil briefly surging toward multi week highs as regional instability persisted. Safe haven metals such as gold also rallied, drawing renewed investor interest amid broader market uncertainty and serving as a hedge against risk. Other commodity prices exhibited mixed performance, with recent sessions showing volatility in precious metals and industrial metals as traders weighed central bank policy expectations, the strength of the U.S. dollar, and global demand prospects. Overall, commodities reflected the broader risk off tone in global markets as supply fears and macroeconomic uncertainty remained at the forefront of pricing dynamics leading into the new week.

Currencies

Last week in global currency markets, major moves were driven by escalating geopolitical tensions in the Middle East and safe haven flows as risk appetite softened. The U.S. dollar strengthened broadly, hitting multi week highs against a basket of currencies as investors sought refuge amid conflict concerns, while the Swiss franc and Japanese yen also appreciated as classic safe haven currencies. Risk sensitive currencies such as the euro slid to lower levels against the dollar, pressured by fears of rising energy prices and uncertainty over growth prospects. Emerging market currencies, including the South African rand and Indian rupee, weakened sharply as heightened geopolitical risk and higher oil prices increased demand for dollars, dragging these currencies toward recent lows. Overall, FX markets reflected a flight to safety, with the dollar and other defensive currencies outperforming while most risk linked currencies lost ground.

Commodities

| Name | 27/02/26 | 31/01/26 | 31/12/25 | 31/12/24 |

|---|---|---|---|---|

| WTI Oil ($/barrel) | $67.02 | $65.21 | $57.42 | $71.72 |

| Brent Oil ($/barrel) | $72.48 | $70.69 | $60.85 | $74.64 |

| Gold ($/oz) | $5278.93 | $4894.23 | $4319.37 | $2624.50 |

| Natural Gas ($/mmBtu) | $2.86 | $4.35 | $3.69 | $3.63 |

Currency

| Name | 27/02/26 | 31/01/26 | 31/12/25 | 31/12/24 |

|---|---|---|---|---|

| Euro (€/$) | 1.1812 | 1.1851 | 1.1746 | 1.0354 |

| Pound (£/$) | 1.3482 | 1.3686 | 1.3475 | 1.2516 |

| Japanese Yen (¥/$) | 156.05 | 154.78 | 156.71 | 157.20 |

| Swiss Franc (CHF/€) | 0.9085 | 0.9163 | 0.9307 | 0.9401 |

| Chinese Yuan Renminbi (CNY/$) | 6.8624 | 6.9569 | 6.9880 | 7.2993 |

Index Valuations

Index Return

| Name | 1 Week (%) | Month-to-Date (%) | Quarter-to-Date (%) | Year-to-Date (%) |

|---|---|---|---|---|

| S&P 500 | -0.42% | -0.76% | 0.67% | 0.67% |

| NASDAQ Composite | -0.94% | -3.33% | -2.39% | -2.39% |

| DJ Industrial Average | -1.28% | 0.31% | 2.12% | 2.12% |

| S&P 400 | -0.85% | 4.12% | 8.33% | 8.33% |

| Russell 2000 | -1.15% | 0.80% | 6.24% | 6.24% |

| S&P 500 Equal Weight | 0.44% | 3.55% | 7.05% | 7.05% |

| STOXX Europe 50 (€) | 0.13% | 3.34% | 6.23% | 6.23% |

| STOXX Europe 600 (€) | 0.53% | 3.89% | 7.26% | 7.26% |

| MSCI EAFE Small Cap | 1.26% | 4.82% | 10.89% | 10.89% |

| FTSE 100 (£) | 2.13% | 7.04% | 10.24% | 10.24% |

| FTSE MIB (€) | 1.59% | 3.70% | 5.37% | 5.37% |

| CAC 40 (€) | 0.77% | 5.60% | 5.31% | 5.31% |

| DAX (€) | 0.09% | 3.04% | 3.24% | 3.24% |

| SWISS MKT (CHF) | 1.12% | 6.26% | 5.63% | 5.63% |

| TOPIX (¥) | 3.42% | 10.44% | 15.57% | 15.57% |

| Nifty 50 | -1.54% | -0.56% | -3.45% | -3.45% |

| Hang Seng (HKD) | 0.82% | -2.76% | 3.93% | 3.93% |

| MSCI World | 0.06% | 0.76% | 3.04% | 3.04% |

| MSCI China Free | -1.58% | -7.03% | -3.21% | -3.21% |

| MSCI EAFE | 1.25% | 4.65% | 10.13% | 10.13% |

| MSCI EM | 2.83% | 5.50% | 14.85% | 14.85% |

| MSCI Brazil (BRL) | -2.30% | 2.11% | 14.77% | 14.77% |

| MSCI India (INR) | -0.89% | 0.30% | -2.59% | -2.59% |

Fixed Income

| Name | 1 Week (%) | Month-to-Date (%) | Quarter-to-Date (%) | Year-to-Date (%) |

|---|---|---|---|---|

| Bloomberg US Aggregate | 0.54% | 1.64% | 1.75% | 1.75% |

| Bloomberg Global Aggregate | 0.50% | 1.12% | 2.06% | 2.06% |

| Bloomberg Euro Aggregate | 0.63% | 0.42% | 2.47% | 2.47% |

| Bloomberg US High Yield | -0.22% | 0.19% | 0.70% | 0.70% |

| Bloomberg Euro High Yield (€) | -0.02% | 0.12% | 0.93% | 0.93% |

Blend Fund Performance (Year-to-Date)

Direct Fund

| (02/03/26) | 1 Week (%) | 1 Month (%) | 6 Months (%) | Year-to-Date (%) | 1 Year (%) | 2 Years (%) |

|---|---|---|---|---|---|---|

| Aditum Global Discovery | 2.00% | 0.01% | 19.58% | 7.41% | 28.63% | 41.80% |

| Aditum India Explorer Fund | -0.64% | 3.12% | 1.84% | -0.84% | - | - |

| Ashoka WhiteOak India Opportunities | -3.95% | -2.55% | -7.90% | -8.37% | 4.32% | - |

| BlackRock GF World Healthscience USD | 0.01% | 1.64% | 14.13% | 2.63% | 8.13% | 11.76% |

| Emirates Global Sukuk | 0.22% | 0.14% | 2.93% | 0.89% | 6.41% | 11.23% |

| Emirates MENA Fixed Income | 0.17% | -0.13% | 3.44% | -0.02% | 7.06% | 12.38% |

| Emirates MENA Top Companies | -0.94% | -2.20% | 5.29% | 5.75% | 2.82% | 6.34% |

| Franklin Gold and Precious Metals USD | 7.67% | 24.24% | 92.76% | 34.18% | 226.96% | 415.57% |

| Harris Associates Global Equity | -0.28% | -1.31% | 7.42% | 0.97% | 11.81% | 20.15% |

| Loomis Sayles Global Growth Equity | -0.31% | -7.35% | -6.53% | -6.88% | 5.23% | 23.05% |

| Loomis Sayles Multisector Income | 0.28% | 1.20% | 3.21% | 1.43% | 7.21% | 15.31% |

| Loomis Sayles US Growth Equity | 1.91% | -4.18% | -1.38% | -6.00% | 7.56% | 27.06% |

| PineBridge Japan Small Cap Equity | 2.25% | 13.15% | 17.32% | 17.21% | 40.77% | 37.19% |

| UBAM 30 Global Leaders Equity | 0.24% | -2.06% | 0.74% | -1.47% | 6.58% | 7.94% |

| iShares US Corporate bond Index | 0.12% | 1.43% | 4.23% | 1.41% | 6.37% | 13.18% |

| iShares Developed World Index | 0.89% | 0.48% | 13.90% | 2.34% | 22.38% | 38.97% |

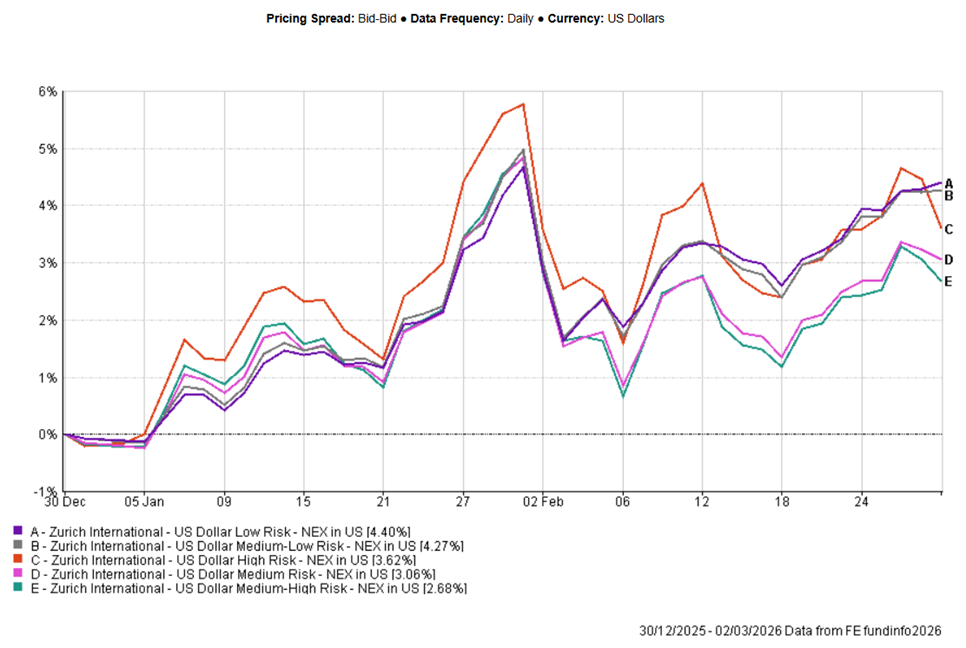

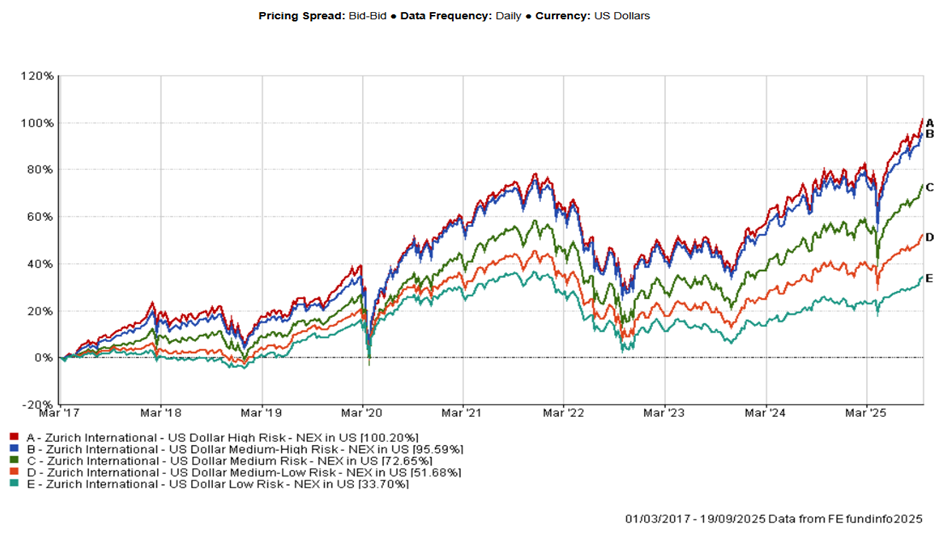

Nexus Blend Funds

| (02/03/26) | 1 Week (%) | 1 Month (%) | 6 Months (%) | Year-to-Date (%) | 1 Year (%) | 2 Years (%) |

|---|---|---|---|---|---|---|

| US Dollar High Risk Blend | 0.05% | 0.05% | 14.87% | 3.62% | 22.40% | 38.32% |

| US Dollar Medium-High Risk Blend | 0.28% | -0.13% | 13.30% | 2.68% | 20.22% | 37.56% |

| US Dollar Medium Risk Blend | 0.56% | 0.21% | 12.93% | 3.06% | 19.20% | 35.30% |

| US Dollar Medium-Low Risk Blend | 0.87% | 1.22% | 13.61% | 4.27% | 18.68% | 32.02% |

| US Dollar Low Risk Blend | 0.95% | 1.48% | 13.32% | 4.40% | 18.01% | 28.14% |

Zurich Mirror Funds

| (02/03/26) | 1 Week (%) | 1 Month (%) | 6 Months (%) | Year-to-Date(%) | 1 Year (%) | 2 Years (%) |

|---|---|---|---|---|---|---|

| Canaccord Genuity Balanced | 0.53% | 0.59% | 6.42% | 2.42% | 11.31% | 18.99% |

| Canaccord Genuity Growth | 0.65% | 0.69% | 7.61% | 2.61% | 13.51% | 21.49% |

| Canaccord Genuity Opportunity | 0.91% | 1.96% | 11.70% | 5.69% | 19.50% | 30.12% |

| Emirates Emerging Market Debt | 0.23% | 0.59% | 3.22% | 1.65% | 4.76% | 15.02% |

| Emirates Islamic Global Balanced | 0.97% | -0.06% | 9.37% | 2.86% | 14.54% | 21.75% |

* Data is lagged by 1 day.

** Data is lagged by 2 days.