June 2025

Monthly Market Update

Overview

Global markets delivered a mixed performance last week, balancing optimism around global trade with heightened geopolitical tensions. U.S. equities rallied (S&P 500 +1.54%) on positive U.S.–China trade developments and easing inflation, strengthening expectations of a Federal Reserve rate pause and potential cuts. European markets slipped slightly amid renewed Middle East unrest and ongoing trade concerns, although the FTSE 100 briefly touched record highs. In Asia, Japan posted moderate gains despite yen strength, while China saw modest gains supported by central bank liquidity measures, even as investor sentiment remained cautious. Indian markets experienced notable volatility, driven by rising oil prices and a sharp sell-off in aviation stocks after the tragic Air India crash. MENA markets declined broadly amid regional instability and rising oil prices, with the Dubai Financial Market and Saudi Arabia’s Tadawul both under pressure, although IPO activity in Dubai and Saudi Arabia remained active. In commodities, oil surged sharply (Brent +7%) on fears of supply disruptions, particularly through the Strait of Hormuz, while gold rose 3.5% as investors sought safe-haven assets. Currency markets reflected a risk-off tone, with the U.S. Dollar Index rebounding 0.4% after hitting a multi-year low, while the euro strengthened to its highest level since 2023 on ECB hawkishness and dollar softness. Overall, markets balanced improving global trade dialogue against intensifying geopolitical tensions, with investor focus now turning to next week’s highly anticipated Federal Reserve policy decision.

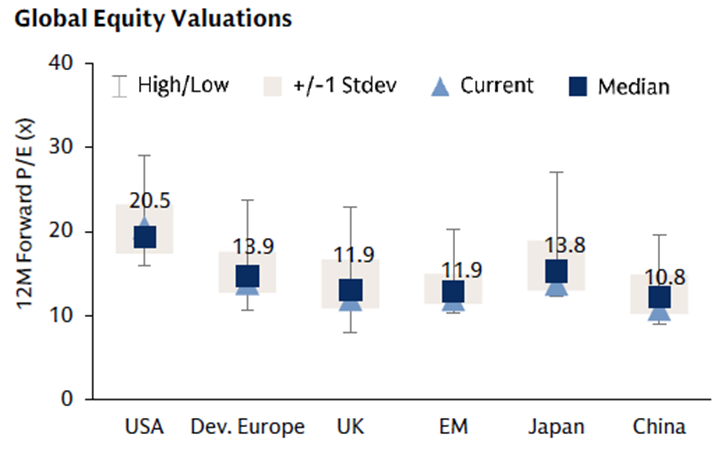

Outlook: The tug-of-war between global economic growth and inflation appears to have reached a more feasible balancing point. Across equity markets, the narrowing of the gulf between growth and value is likely to continue as a greater number of industries start to benefit from higher earnings and improving monetary and fiscal policies. 2025 likely will not be a year of robust economic (GDP growth: U.S. growth is forecast to grow at a modest 1.5%-2.5%, with the Eurozone and Chinese growth lagging. In this environment, investors could benefit from an increased allocation towards value names whilst avoiding an overexposure to growth. Nonetheless, we continue to buy high-quality, profitable, blue-chip equities with strong balance sheets and positive free-cashflow yields. Fixed-income securities also offer attractive yields at these levels, without subjecting portfolios to much downside risk. Emerging market equities and small companies are also available at attractive valuations relative to US Blue Chips. The overall outlook for equities remains cautiously optimistic, supported by a more dovish US Federal Reserve and a resilient US economy, though global risks and sector-specific performance will be closely watched.

Developed Markets

North America

U.S. equities posted solid gains last week, with the S&P 500 up 1.54%, the Nasdaq 100 rising 2.00%, and the Russell 2000 advancing 3.23%. Market sentiment improved following progress in U.S.–China trade negotiations in London, where both sides reached preliminary agreements on rare earth exports and student visa policies, easing bilateral tensions and lifting investor optimism. Midweek, markets faced renewed geopolitical risks as reports of Israeli airstrikes on Iranian infrastructure briefly drove crude oil prices up nearly 10% before stabilizing. Despite this, equities remained resilient, supported by softer inflation data—May CPI rose just 0.1% month-over-month (2.4% year-over-year), and core CPI also increased 0.1%, reinforcing expectations that the Federal Reserve will maintain its benchmark interest rate at 4.25% – 4.50% in the June 17–18 policy meeting, with the potential for a rate cut later in Q3 or Q4. Although President Trump reiterated tariff threats on foreign imports, triggering some headline-driven volatility, investors largely focused on the positive momentum in trade relations. Looking ahead, markets will closely watch the Fed’s policy guidance and Chair Powell’s remarks to gauge the central bank’s stance on inflation and its response to growing geopolitical uncertainty.

Europe & UK

European equity markets ended the last week with modest declines as geopolitical tensions and trade uncertainty weighed on sentiment; the pan-European STOXX 600 slipped 0.1%, Germany’s DAX fell 0.3%, and France’s CAC 40 dipped 0.2%. In contrast, the UK’s FTSE 100 remained relatively stable, gaining 0.02% and briefly touching a record high of 8,884.92 on June 12 before retreating by approximately 0.5% by week’s end due to heightened Middle East tensions following Israeli airstrikes on Iranian targets. UK market resilience was supported by optimism around the UK–US Economic Prosperity Deal, which reduced tariffs on selected UK exports such as steel and automobiles, although a 10% baseline tariff persists, underscoring ongoing protectionist sentiment. The Bank of England’s earlier decision in May to cut interest rates by 25 bps to 4.25% in a narrow 5-4 vote also continued to influence investor expectations, as policymakers cited the risks posed by global trade disruptions. By Friday, surging crude prices—triggered by the escalation in Middle East conflict—pressured European equities, with travel and leisure stocks underperforming while energy, defence, and precious metals sectors saw gains. Looking ahead, market focus will turn to the evolution of UK–US trade relations, the Bank of England’s policy direction, and the broader impact of geopolitical instability on investor sentiment and sectoral rotation.

Japan

Japanese markets had a mixed performance during last week, as external uncertainties and domestic policy shifts influenced sentiment; the Nikkei 225 initially surged past 38,000 driven by continued foreign inflows and gains in semiconductor and tech stocks like Advantest but later softened due to heightened Middle East tensions and a stronger yen, ending the week with modest gains of around 1.3%. Economic data painted a slightly improved picture, with Q1 GDP revised to a smaller contraction of -0.2% annualized (from -0.7%) and industrial production showing a mixed trend—down 1.1% month-over-month but up 0.5% year-over-year. Inflation pressures remained persistent, with April CPI at 3.6%, above the Bank of Japan’s target. At its June 16–17 policy meeting, the BOJ maintained its benchmark rate at 0.5%, reaffirmed its bond tapering path through March 2026, but signalled a slower pace thereafter to reduce volatility in long-dated yields, which have surged recently amid global uncertainty.

Governor Ueda reiterated that further rate hikes remain possible if inflation stabilizes near 2%, though market consensus via a Reuters poll suggests any hike may be delayed until Q1 2026. Domestically, policymakers continued debating proposed ¥30,000–40,000 cash handouts to help households cope with inflation, a move aligned with political priorities ahead of July’s upper house election. Looking ahead, Japan’s outlook will hinge on the BOJ’s cautious policy pivot, yen movements, and evolving global geopolitical and trade dynamics.

Emerging Markets

China

Chinese equity markets delivered a muted yet cautiously positive performance during last week, with the CSI 300 gaining around 0.8% midweek on modest progress in U.S.–China trade talks—particularly a preliminary framework on rare earth exports—though gains were restrained by skepticism over implementation and lingering tariff concerns. The Shanghai Composite and Shenzhen Component also reflected this cautious optimism, supported by continued central bank easing but limited by profit-taking and geopolitical uncertainty. The People’s Bank of China maintained its aggressive liquidity stance, injecting ¥400 billion via six-month reverse repos on June 16, following a ¥1 trillion three-month injection earlier in the month, in a bid to stabilize interbank funding and sustain credit flow. The PBOC kept the seven-day reverse repo rate unchanged at 1.50%, indicating policy flexibility while urging banks to expand lending to key areas like consumption, trade, and small businesses. Domestic investor sentiment remained steady, with markets largely range-bound as participants weighed the effectiveness of stimulus measures against ongoing trade frictions, property sector weakness, and geopolitical risks. Looking ahead, attention will center on upcoming leadership talks between Presidents Trump and Xi, the Lujiazui Forum where further PBOC guidance may emerge, and the central bank’s balancing act between supporting growth and preserving financial stability.

India

Indian equity markets experienced heightened volatility during the last week, driven by a mix of global geopolitical tensions and domestic developments; the BSE Sensex declined by approximately 0.7% to close at 81,118.60, while the Nifty 50 fell 0.68% to 24,718.60. Midweek sentiment was rattled by a sharp sell-off—Sensex dropped over 823 points—as the escalating Israel–Iran conflict triggered a spike in oil prices and reignited global trade uncertainties. Thursday’s decline was led by weakness in IT, energy, PSU banks, and FMCG stocks, further exacerbated by risk aversion ahead of the weekly F&O expiry. Tensions with Pakistan also added to investor caution despite a temporary ceasefire easing immediate conflict fears. Externally, unresolved U.S.–China tariff issues continued to cloud the global trade outlook. Domestically, surging oil prices extended inflationary pressures, hitting sectors like aviation and energy, while the tragic Air India crash near Ahmedabad further dented aviation sentiment. However, markets rebounded strongly on Monday, with the Sensex gaining 0.84% to close at 81,796 and the Nifty rising 0.92% to 24,946, as oil prices eased and optimism around global trade talks returned. Looking ahead, investor focus will remain on evolving geopolitical developments—including Middle East dynamics and India–Pakistan relations—as well as oil price trends and global trade negotiations, all of which continue to shape near-term market risk appetite.

MENA

Equity markets across the MENA region experienced notable volatility during the last week, as geopolitical tensions escalated following Israeli airstrikes on Iran. The Dubai Financial Market General Index (DFMGI) declined by approximately 1.5%, with a sharp sell-off on Friday driven by weakness in key real estate stocks such as Emaar Properties and Emaar Development, despite earlier gains fueled by optimism surrounding U.S.–China trade talks. Abu Dhabi’s exchange showed relative resilience, recovering modestly on Monday on the back of gains in energy-related shares. In Saudi Arabia, the Tadawul All Share Index (TASI) fell around 1.3%, weighed down by declines in Al Rajhi Bank and Saudi Aramco as risk aversion and profit-taking set in. Regionally, performance was mixed – Qatar’s index dropped 2.9% on Sunday amid heightened Middle East tensions, while Kuwait and Egypt also posted losses. Crude oil surged by 6–7% during the week, driven by elevated geopolitical risk premiums, while gold climbed roughly 3.5% on increased safe-haven demand. Bond yields in the region edged higher and regional currencies, including the Israeli shekel, faced downward pressure. Despite the volatility, capital markets activity remained robust: Dubai Residential REIT completed its listing on the Dubai Financial Market, becoming one of the largest publicly traded REITs in the region, and Saudi Arabia’s IPO pipeline remained active, reflecting sustained investor interest in sector diversification. On the macroeconomic front, the UAE’s latest GDP data reinforced expectations for 4–4.5% non-oil growth in 2025. Looking ahead, regional markets will remain highly sensitive to geopolitical developments, oil price movements, and the trajectory of global trade negotiations, while continued IPO activity and stable monetary policy may help anchor investor confidence.

Commodities and Forex

Commodities

Oil prices surged sharply during the last week, amid escalating Middle East tensions following Israeli strikes on Iranian targets, with Brent crude futures climbing approximately 7% to close at $77.01 per barrel, up from $69.36 the previous week. U.S. West Texas Intermediate (WTI) posted similar gains, ending the week around $74.93, as concerns mounted over potential disruptions to global oil supply—particularly through the strategically critical Strait of Hormuz. Despite prior expectations that OPEC+ might consider increasing output, geopolitical risks overshadowed supply-demand fundamentals and dominated price movements. Meanwhile, gold extended its role as a safe-haven asset, trading within a volatile range before settling near $3,368 per ounce, having fluctuated between $3,385 and $3,435 during the week. The surge in gold prices was fuelled by heightened geopolitical risk premiums and shifting investor sentiment in response to mixed inflation data and evolving Federal Reserve guidance, underscoring gold’s appeal as a defensive hedge amid global uncertainty.

Currencies

The U.S. Dollar Index (DXY) rebounded to ~98.18 after dipping to a three-year low earlier in the week, climbing approximately 0.4% amid renewed safe-haven flows triggered by Israeli strikes on Iran. Still, the dollar posted a monthly decline of around 2.8%, weighed down by soft U.S. inflation data and growing expectations for Federal Reserve rate cuts later this year. Conversely, the euro strengthened, trading in a range between $1.142–$1.163, closing the week near $1.155, its highest level since mid-2023. This euro strength was driven by a combination of easing dollar pressure, hawkish comments from ECB Vice President de Guindos on maintaining inflation targeting, and anticipation of the ECB pausing further rate cuts.

Commodities

| Name | 11/07/25 | 30/06/25 | 31/03/25 | 31/12/24 |

|---|---|---|---|---|

| WTI Oil ($/barrel) | $68.45 | $65.11 | $71.48 | $71.72 |

| Brent Oil ($/barrel) | $70.36 | $67.61 | $74.74 | $74.64 |

| Gold ($/oz) | $3355.59 | $3303.14 | $3123.57 | $2624.50 |

| Natural Gas ($/mmBtu) | $3.31 | $3.46 | $4.12 | $3.63 |

Currencies

| Name | 11/07/25 | 30/06/25 | 31/03/25 | 31/12/24 |

|---|---|---|---|---|

| Euro (€/$) | 1.1689 | 1.1787 | 1.0816 | 1.1041 |

| Pound (£/$) | 1.3493 | 1.3732 | 1.2516 | 1.2746 |

| Japanese Yen (¥/$) | 147.43 | 144.03 | 157.20 | 141.02 |

| Swiss Franc (CHF/€) | 0.9314 | 0.9348 | 0.9401 | 0.9289 |

| Chinese Yuan Renminbi (CNY/$) | 7.1701 | 7.1638 | 7.2993 | 7.0842 |

Index Valuations

Index Return

| Equities | 1 Week | MTD | QTD | YTD |

|---|---|---|---|---|

| S&P 500 | -0.29% | 0.92% | 0.92% | 7.18% |

| NASDAQ Composite | -0.06% | 1.09% | 1.09% | 7.01% |

| DJ Industrial Average | -1.01% | 0.67% | 0.67% | 5.25% |

| S&P 400 | -0.58% | 2.27% | 2.27% | 2.47% |

| Russell 2000 | -0.62% | 2.78% | 2.78% | 0.94% |

| S&P 500 Equal Weight | -0.44% | 1.45% | 1.45% | 6.34% |

| STOXX Europe 50 (€) | 1.79% | 1.58% | 1.58% | 12.82% |

| STOXX Europe 600 (€) | 1.15% | 1.16% | 1.16% | 10.70% |

| MSCI EAFE Small Cap | 0.00% | 0.37% | 0.37% | 21.68% |

| FTSE 100 (£) | 1.34% | 2.07% | 2.07% | 11.72% |

| FTSE MIB (€) | 1.15% | 0.72% | 0.72% | 21.24% |

| CAC 40 (€) | 1.73% | 2.20% | 2.20% | 9.16% |

| DAX (€) | 1.97% | 1.45% | 1.45% | 21.83% |

| SWISS MKT (CHF) | -0.29% | 0.13% | 0.13% | 6.05% |

| TOPIX (¥) | -0.17% | -1.04% | -1.04% | 1.38% |

| Nifty 50 | -1.22% | -1.44% | -1.38% | 6.37% |

| Hang Seng (HKD) | 0.93% | 0.28% | 0.46% | 20.34% |

| MSCI World | -0.34% | 0.55% | 0.55% | 10.35% |

| MSCI China Free | 0.96% | 0.68% | 0.68% | 15.96% |

| MSCI EAFE | -0.23% | -0.20% | -0.20% | 19.70% |

| MSCI EM | -0.15% | 0.73% | 0.73% | 16.37% |

| MSCI Brazil (BRL) | -3.86% | -2.40% | -2.40% | 13.31% |

| MSCI India (INR) | -1.32% | -1.51% | -1.51% | 4.57% |

Fixed Income

| (14/07/25) | 1 week % | 1 month % | 6 months % | YTD % | 1 year % | 2 years % |

|---|---|---|---|---|---|---|

| US dollar Adventurous | -0.07% | 2.80% | 11.60% | 10.21% | 7.58% | 24.62% |

| US dollar Performance | 0.04% | 2.96% | 8.27% | 7.33% | 7.60% | 22.53% |

| US dollar Blue Chip | -0.01% | 2.43% | 6.21% | 5.26% | 6.06% | 17.87% |

| US dollar Cautious | -0.09% | 1.64% | 5.20% | 4.17% | 4.70% | 12.28% |

| US dollar Defensive | -0.21% | 0.74% | 4.66% | 3.53% | 3.39% | 7.50% |

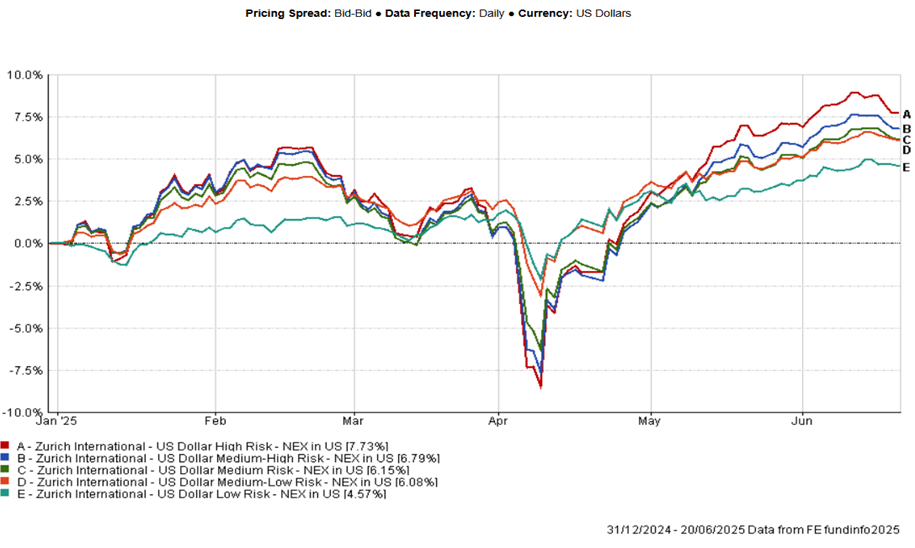

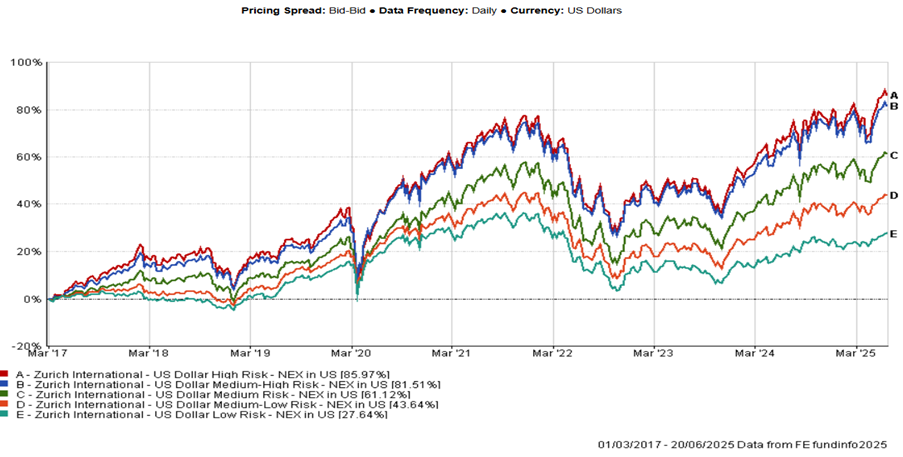

Blend Fund Performance Year To Date:

Blend Fund Performance Since Inception:

Direct Fund Name

| (14/07/25) | 1 week % | 1 month % | 6 months % | YTD % | 1 year % | 2 years % |

|---|---|---|---|---|---|---|

| Aditum Global Discovery | -0.34% | 1.20% | 8.75% | 8.43% | 6.32% | 24.82% |

| Ashoka WhiteOak India Opportunities | -1.00% | 1.78% | 5.96% | -0.86% | 0.51% | - |

| BlackRock GF World Healthscience USD | -0.12% | -1.29% | -1.42% | -0.57% | -9.53% | 3.19% |

| Emirates Global Sukuk | 0.00% | 0.77% | 3.83% | 3.35% | 4.95% | 8.99% |

| Emirates MENA Fixed Income | 0.06% | 1.24% | 4.67% | 3.58% | 4.38% | 9.64% |

| Emirates MENA Top Companies | 0.67% | 3.13% | 0.62% | 2.40% | 6.46% | 2.62% |

| Franklin Gold and Precious Metals USD | 1.00% | -4.23% | 56.64% | 67.52% | 56.42% | 87.33% |

| Harris Associates Global Equity | 0.48% | 2.36% | 12.21% | 11.16% | 8.40% | 10.25% |

| Loomis Sayles Global Growth Equity | -1.52% | 1.65% | 12.71% | 11.27% | 19.80% | 45.11% |

| Loomis Sayles Multisector Income | -0.24% | 1.02% | 4.66% | 3.95% | 6.59% | 14.26% |

| PineBridge Japan Small Cap Equity | 0.71% | 0.46% | 21.60% | 16.58% | 10.74% | 0.96% |

| UBAM 30 Global Leaders Equity | -0.88% | 0.60% | 6.88% | 5.92% | 3.48% | 19.50% |

| iShares US Corporate bond Index | -0.22% | 0.70% | 4.41% | 3.22% | 4.61% | 11.72% |

| iShares Developed World Index | 0.30% | 3.08% | 10.98% | 9.80% | 13.85% | 41.31% |

Zurich Managed Funds

| (14/07/25) | 1 week % | 1 month % | 6 months % | YTD % | 1 year % | 2 years % |

|---|---|---|---|---|---|---|

| US dollar Adventurous | -0.07% | 2.80% | 11.60% | 10.21% | 7.58% | 24.62% |

| US dollar Performance | 0.04% | 2.96% | 8.27% | 7.33% | 7.60% | 22.53% |

| US dollar Blue Chip | -0.01% | 2.43% | 6.21% | 5.26% | 6.06% | 17.87% |

| US dollar Cautious | -0.09% | 1.64% | 5.20% | 4.17% | 4.70% | 12.28% |

| US dollar Defensive | -0.21% | 0.74% | 4.66% | 3.53% | 3.39% | 7.50% |

Zurich Mirror Funds

| (14/07/25) | 1 week % | 1 month % | 6 months % | YTD % | 1 year % | 2 years % |

|---|---|---|---|---|---|---|

| Canaccord Genuity Balanced | -0.26% | 1.05% | 6.15% | 4.93% | 4.89% | 14.96% |

| Canaccord Genuity Growth | -0.22% | 1.52% | 6.77% | 5.23% | 4.95% | 16.59% |

| Canaccord Genuity Opportunity | -0.11% | 1.70% | 8.19% | 6.78% | 7.53% | 23.18% |

| Emirates Emerging Market Debt | 0.16% | 1.72% | 2.77% | 2.34% | 6.83% | 14.64% |

| Emirates Islamic Balanced Managed | 0.10% | 1.18% | 4.17% | 3.91% | 3.97% | 14.84% |

| Loomis Sayles US Growth Equity | -1.20% | 2.84% | 7.17% | 4.89% | 17.74% | 46.16% |

* Data is lagged by 1 day.

** Data is lagged by 2 days.