February 2026

Monthly Market Update

Overview

Last week, global markets were mixed as investors reacted to geopolitics, economic data, and central bank signals. In the U.S., stocks rose, led by the Nasdaq, supported by the Supreme Court’s tariff decision, though slower growth and higher inflation kept the mood cautious. Europe saw broad gains, with the STOXX Europe 600 hitting a new high, even as German confidence eased and UK inflation slowed. Japan’s markets dipped slightly, with low GDP growth, weak inflation, and a softer yen, while Prime Minister Takaichi pledged responsible fiscal spending. In emerging markets, China’s markets were mostly closed for Lunar New Year, with focus on consumption-led growth and higher telecom VAT, while India’s equities fell sharply amid U.S.–Iran tensions, with IT, metals, and realty sectors hit hardest. MENA markets swung between small gains and sharp losses, reacting to nuclear talks and heightened regional tensions. Commodities were driven higher by energy and safe-haven demand, with oil near seven-month highs and gold and silver rising. Currency markets were volatile, with the dollar softening against the euro, yen, and pound as trade policy uncertainty and risk-off sentiment shaped investor moves. Overall, markets reflected a mix of optimism from policy and earnings but were dominated by caution amid geopolitical and economic uncertainty.

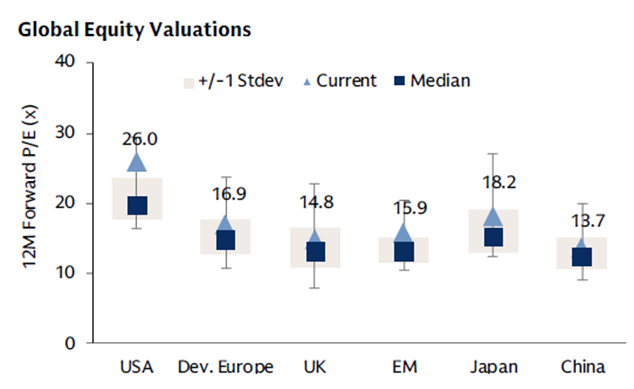

Outlook: As we move into 2026, the tug-of-war between global growth and inflation has moderated, allowing central banks greater flexibility to shift from restrictive policy toward gradual easing. While the pace of rate cuts is likely to be measured, monetary conditions are becoming more supportive for risk assets. We continue to favour equities, with a focus on high-quality, profitable, blue-chip companies that exhibit strong balance sheets, durable earnings and healthy free-cash-flow generation. Fixed income remains an important portfolio anchor, with yields still attractive by historical standards and offering income and diversification benefits without excessive duration risk. Beyond developed markets, emerging market equities and smaller companies continue to trade at compelling valuation discounts relative to US large-cap peers, presenting selective opportunities for long-term investors. Overall, the outlook for equities in 2026 remains cautiously constructive, supported by easing financial conditions, resilient corporate fundamentals and improving global liquidity, while acknowledging that geopolitical risks, fiscal dynamics and sector-level dispersion will remain key factors to monitor.

Developed Markets

North America

Last week, U.S. stocks closed higher despite the Presidents’ Day holiday, led by the Nasdaq with a 1.5% gain, while the S&P 500 and S&P Midcap 400 also rose over 1% and the Dow barely increased. Markets were supported by the Supreme Court’s decision to overturn Trump-era global tariffs, though tensions with Iran pushed oil prices up. Economic data showed slowing growth, with Q4 GDP rising just 1.4% and core PCE inflation climbing to 3.0% year over year. Business activity slowed to a 10-month low, homebuilder confidence and pending home sales fell, but housing starts increased. In bonds, Treasuries fell, investment-grade corporates were stable, and high-yield bonds rose alongside equities, particularly in the technology sector. The Federal Reserve’s January meeting minutes showed that policymakers remain divided on whether to raise or cut rates in the near term, citing persistent inflation risks. Consumer spending, a key driver of the economy, slowed in the fourth quarter, reflecting affordability challenges and cautious sentiment. Despite the slowdown, businesses remain optimistic, with output expectations for the year reaching a 13-month high. In housing, affordability issues continued to weigh on buyers, even as new construction rose more than expected. Overall, the market reflected a mix of optimism from policy developments and caution from slowing economic indicators.

Europe & UK

Last week, European stocks rose strongly, with the STOXX Europe 600 Index hitting a new high and gaining 2.08%, supported by improved earnings expectations, positive macroeconomic data, and investors’ desire to diversify beyond the U.S. tech-heavy market. France’s CAC 40 gained 2.45%, Italy’s FTSE MIB and the UK’s FTSE 100 both rose 2.29%, while Germany’s DAX added 1.39%. Economic data was mixed: eurozone industrial production fell 1.4% in December, larger than expected, but the early February PMI showed new orders rising at the fastest pace in nearly four years. German investor confidence eased slightly in February after hitting a five-year high in January. Central bank developments also drew attention, as reports suggested ECB President Christine Lagarde may step down early, while UK CPI inflation fell to 3.0% in January, unemployment rose to 5.2%, and wage growth slowed, boosting expectations for a potential Bank of England rate cut in March. Overall, European markets showed resilience amid positive earnings and PMI readings, despite slower industrial activity and easing confidence in Germany, with policy developments adding further focus for investors.

Japan

Last week, Japan’s stock markets saw modest declines, with the Nikkei 225 falling 0.20% and the broader TOPIX down 0.27%, as geopolitical tensions weighed on investors’ risk appetite. The yen weakened to around JPY 154 against the U.S. dollar from JPY 152.7 the previous week, reflecting slower economic growth and subdued inflation. Japan’s Q4 GDP expanded just 0.2% quarter over quarter, below expectations of 1.6%, with private consumption slowing and exports only modestly declining, though January export growth surprised on strength in shipments to Asia and Europe. Consumer inflation rose at its slowest pace in two years, with core CPI up 2.0% year over year in January, aided by softer food and fuel prices and government measures to ease cost-of-living pressures. In fiscal policy, Prime Minister Sanae Takaichi pledged responsible and proactive spending, emphasizing capital investment in economic security, agriculture, energy, and health services, which helped ease concerns and contributed to a fall in 10-year government bond yields to around 2.10%. Overall, Japan’s markets reflected cautious investor sentiment amid slower growth and low inflation, with policy measures providing some reassurance.

Emerging Markets

China

Last week, financial markets in mainland China were closed for the Lunar New Year holidays from February 16 and will reopen on February 24, while Hong Kong’s market resumed trading on Friday after a brief holiday break, with the Hang Seng Index falling 0.58%. The IMF expects China’s economy to grow 4.5% in 2026, slightly higher than its October forecast but below 2025’s 5% growth and emphasized that transitioning to a consumption-led growth model should be the country’s top priority. China also raised the VAT rate on telecommunication services from 6% to 9%, a move that major telecom providers warned could affect revenue amid slower economic growth and deflationary pressures. On the geopolitical front, the U.S. briefly added then removed several Chinese firms—including Alibaba, Baidu, BYD, and TP-Link—to a list of companies allegedly supporting China’s military, which could have restricted their access to U.S. military contracts and research funding. Overall, markets reflected a cautious tone amid holiday closures, policy adjustments, and ongoing geopolitical uncertainties, while structural economic reforms remain a focus for China’s medium-term growth strategy.

India

Last week, Indian equity markets closed lower amid rising risk-off sentiment driven by escalating U.S.-Iran tensions and a 10-day ultimatum, which weighed heavily on investor confidence. The India VIX surged 2.63% to 14.36, signalling a sharp rise in market fear. The Nifty 50 fell 2.31% to 25,571.25, while the Nifty Midcap 150 and Nifty Small cap 250 dropped 2.85% and 2.73%, respectively, reflecting broad-based profit booking. Sectoral losses were widespread, with Nifty IT leading the decline at -3.41% amid weak global tech sentiment, followed by Nifty Metal at -3.21% and Nifty Realty at -2.57%, while defensive sectors like Nifty FMCG also fell -1.93%. Only Nifty Media and Nifty PSU Bank showed relative resilience, slipping just -0.21% and -0.73%, respectively, as the market grappled with heightened geopolitical uncertainty.

MENA

Last week in the MENA region, stock markets swung between cautious gains and sharp losses as investors reacted to evolving geopolitical developments and mixed economic signals. On Monday, optimism returned as hopes of progress in U.S.–Iran nuclear talks lifted sentiment, with Saudi Arabia’s main index inching up ~0.3%, Dubai’s benchmark rising nearly 1.8%, Abu Dhabi up ~0.6%, and Qatar climbing ~1.1% as banking stocks strengthened; Egypt’s EGX30 also surged ~2.6% on positive IMF support news. However, heightened U.S.–Iran tensions later in the week triggered risk off trading, leading to broad sell offs across Gulf bourses — Saudi’s TASI fell ~1.9%, Dubai and Abu Dhabi indexes both slid, and Egypt’s blue chip EGX30 dropped sharply, underlining investor caution amid geopolitical uncertainty. Overall, markets showed high volatility, with sentiment fluctuating between relief rallies on diplomatic progress and sharp declines when tensions escalated, reflecting the region’s sensitivity to geopolitical risk and its impact on oil prices and capital flows.

Commodities and Forex

Commodities

Last week, commodities were dominated by geopolitical risk and rising energy prices, with crude oil pushing to near seven month highs as escalating U.S.–Iran tensions and potential supply risks drove bullish sentiment for energy markets; Brent crude climbed toward the mid $70s per barrel while WTI also strengthened on these concerns. Precious metals remained strong, with gold holding above key psychological levels and silver also elevated on safe haven demand amid global uncertainty and risk aversion. Data from commodity markets show that over the week Brent and WTI prices were up, reflecting tightening risk premia and geopolitical focus. Meanwhile, broader market price tables indicate that over the past week gold and silver registered notable gains, and industrial metals such as copper also showed positive performance, even as some energy components like natural gas remained mixed. Overall, energy and precious metals led commodities higher, driven by geopolitical concerns and flight to safety flows, even as other segments saw varied movement reflecting global demand and inventory dynamics.

Currencies

Since last week, global currency markets have been driven by renewed trade policy uncertainty and safe haven flows, with the U.S. dollar initially on a strong weekly footing but then softening amid tariff confusion and risk off sentiment following the U.S. Supreme Court’s rejection of prior tariff authority and the subsequent announcement of new levies. The greenback weakened against major peers such as the euro, Japanese yen and Swiss franc as investors sought clarity on the implications of shifting U.S. tariff rules and wider trade disruptions. The British pound gained modestly on a softer dollar backdrop, supported by expectations of upcoming Bank of England policy shifts. Meanwhile, in Asia, the Japanese yen showed resiliesnce as markets reacted to tariff linked uncertainty and potential FX policy actions, and the Indian rupee saw support as the Reserve Bank of India likely intervened to limit losses, even as risk aversion persisted. Overall, FX markets reflected heightened volatility and cautious positioning, with currencies reacting to the interplay of trade policy risk, central bank expectations, and safe haven demand.

Commodities

| Name | 27/02/26 | 31/01/26 | 31/12/25 | 31/12/24 |

|---|---|---|---|---|

| WTI Oil ($/barrel) | $67.02 | $65.21 | $57.42 | $71.72 |

| Brent Oil ($/barrel) | $72.48 | $70.69 | $60.85 | $74.64 |

| Gold ($/oz) | $5278.93 | $4894.23 | $4319.37 | $2624.50 |

| Natural Gas ($/mmBtu) | $2.86 | $4.35 | $3.69 | $3.63 |

Currencies

| Name | 27/02/26 | 31/01/26 | 31/12/25 | 31/12/24 |

|---|---|---|---|---|

| Euro (€/$) | 1.1812 | 1.1851 | 1.1746 | 1.0354 |

| Pound (£/$) | 1.3482 | 1.3686 | 1.3475 | 1.2516 |

| Japanese Yen (¥/$) | 156.05 | 154.78 | 156.71 | 157.20 |

| Swiss Franc (CHF/€) | 0.9085 | 0.9163 | 0.9307 | 0.9401 |

| Chinese Yuan Renminbi (CNY/$) | 6.8624 | 6.9569 | 6.9880 | 7.2993 |

Index Valuations

Index Return

| Name | 1 Week (%) | Month-to-Date (%) | Quarter-to-Date (%) | Year-to-Date (%) |

|---|---|---|---|---|

| S&P 500 | -0.42% | -0.76% | 0.67% | 0.67% |

| NASDAQ Composite | -0.94% | -3.33% | -2.39% | -2.39% |

| DJ Industrial Average | -1.28% | 0.31% | 2.12% | 2.12% |

| S&P 400 | -0.85% | 4.12% | 8.33% | 8.33% |

| Russell 2000 | -1.15% | 0.80% | 6.24% | 6.24% |

| S&P 500 Equal Weight | 0.44% | 3.55% | 7.05% | 7.05% |

| STOXX Europe 50 (€) | 0.13% | 3.34% | 6.23% | 6.23% |

| STOXX Europe 600 (€) | 0.53% | 3.89% | 7.26% | 7.26% |

| MSCI EAFE Small Cap | 1.26% | 4.82% | 10.89% | 10.89% |

| FTSE 100 (£) | 2.13% | 7.04% | 10.24% | 10.24% |

| FTSE MIB (€) | 1.59% | 3.70% | 5.37% | 5.37% |

| CAC 40 (€) | 0.77% | 5.60% | 5.31% | 5.31% |

| DAX (€) | 0.09% | 3.04% | 3.24% | 3.24% |

| SWISS MKT (CHF) | 1.12% | 6.26% | 5.63% | 5.63% |

| TOPIX (¥) | 3.42% | 10.44% | 15.57% | 15.57% |

| Nifty 50 | -1.54% | -0.56% | -3.45% | -3.45% |

| Hang Seng (HKD) | 0.82% | -2.76% | 3.93% | 3.93% |

| MSCI World | 0.06% | 0.76% | 3.04% | 3.04% |

| MSCI China Free | -1.58% | -7.03% | -3.21% | -3.21% |

| MSCI EAFE | 1.25% | 4.65% | 10.13% | 10.13% |

| MSCI EM | 2.83% | 5.50% | 14.85% | 14.85% |

| MSCI Brazil (BRL) | -2.30% | 2.11% | 14.77% | 14.77% |

| MSCI India (INR) | -0.89% | 0.30% | -2.59% | -2.59% |

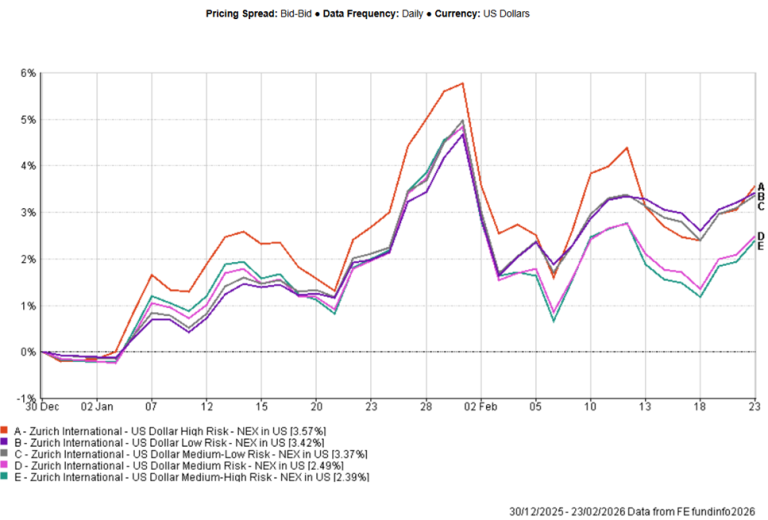

Nexus Blend Funds

| (02/03/26) | 1 Week (%) | 1 Month (%) | 6 Months (%) | Year-to-Date (%) | 1 Year (%) | 2 Years (%) |

|---|---|---|---|---|---|---|

| US Dollar High Risk Blend | 0.05% | 0.05% | 14.87% | 3.62% | 22.40% | 38.32% |

| US Dollar Medium-High Risk Blend | 0.28% | -0.13% | 13.30% | 2.68% | 20.22% | 37.56% |

| US Dollar Medium Risk Blend | 0.56% | 0.21% | 12.93% | 3.06% | 19.20% | 35.30% |

| US Dollar Medium-Low Risk Blend | 0.87% | 1.22% | 13.61% | 4.27% | 18.68% | 32.02% |

| US Dollar Low Risk Blend | 0.95% | 1.48% | 13.32% | 4.40% | 18.01% | 28.14% |

Blend Fund Performance (Year-to-Date)

Direct Fund Name

| (02/03/26) | 1 Week (%) | 1 Month (%) | 6 Months (%) | Year-to-Date (%) | 1 Year (%) | 2 Years (%) |

|---|---|---|---|---|---|---|

| Aditum Global Discovery | 2.00% | 0.01% | 19.58% | 7.41% | 28.63% | 41.80% |

| Aditum India Explorer Fund | -0.64% | 3.12% | 1.84% | -0.84% | - | - |

| Ashoka WhiteOak India Opportunities | -3.95% | -2.55% | -7.90% | -8.37% | 4.32% | - |

| BlackRock GF World Healthscience USD | 0.01% | 1.64% | 14.13% | 2.63% | 8.13% | 11.76% |

| Emirates Global Sukuk | 0.22% | 0.14% | 2.93% | 0.89% | 6.41% | 11.23% |

| Emirates MENA Fixed Income | 0.17% | -0.13% | 3.44% | -0.02% | 7.06% | 12.38% |

| Emirates MENA Top Companies | -0.94% | -2.20% | 5.29% | 5.75% | 2.82% | 6.34% |

| Franklin Gold and Precious Metals USD | 7.67% | 24.24% | 92.76% | 34.18% | 226.96% | 415.57% |

| Harris Associates Global Equity | -0.28% | -1.31% | 7.42% | 0.97% | 11.81% | 20.15% |

| Loomis Sayles Global Growth Equity | -0.31% | -7.35% | -6.53% | -6.88% | 5.23% | 23.05% |

| Loomis Sayles Multisector Income | 0.28% | 1.20% | 3.21% | 1.43% | 7.21% | 15.31% |

| Loomis Sayles US Growth Equity | 1.91% | -4.18% | -1.38% | -6.00% | 7.56% | 27.06% |

| PineBridge Japan Small Cap Equity | 2.25% | 13.15% | 17.32% | 17.21% | 40.77% | 37.19% |

| UBAM 30 Global Leaders Equity | 0.24% | -2.06% | 0.74% | -1.47% | 6.58% | 7.94% |

| iShares US Corporate bond Index | 0.12% | 1.43% | 4.23% | 1.41% | 6.37% | 13.18% |

| iShares Developed World Index | 0.89% | 0.48% | 13.90% | 2.34% | 22.38% | 38.97% |

Nexus Blend Funds

| (02/03/26) | 1 Week (%) | 1 Month (%) | 6 Months (%) | Year-to-Date (%) | 1 Year (%) | 2 Years (%) |

|---|---|---|---|---|---|---|

| US Dollar High Risk Blend | 0.05% | 0.05% | 14.87% | 3.62% | 22.40% | 38.32% |

| US Dollar Medium-High Risk Blend | 0.28% | -0.13% | 13.30% | 2.68% | 20.22% | 37.56% |

| US Dollar Medium Risk Blend | 0.56% | 0.21% | 12.93% | 3.06% | 19.20% | 35.30% |

| US Dollar Medium-Low Risk Blend | 0.87% | 1.22% | 13.61% | 4.27% | 18.68% | 32.02% |

| US Dollar Low Risk Blend | 0.95% | 1.48% | 13.32% | 4.40% | 18.01% | 28.14% |

Zurich Mirror Funds

| (02/03/26) | 1 Week (%) | 1 Month (%) | 6 Months (%) | Year-to-Date(%) | 1 Year (%) | 2 Years (%) |

|---|---|---|---|---|---|---|

| Canaccord Genuity Balanced | 0.53% | 0.59% | 6.42% | 2.42% | 11.31% | 18.99% |

| Canaccord Genuity Growth | 0.65% | 0.69% | 7.61% | 2.61% | 13.51% | 21.49% |

| Canaccord Genuity Opportunity | 0.91% | 1.96% | 11.70% | 5.69% | 19.50% | 30.12% |

| Emirates Emerging Market Debt | 0.23% | 0.59% | 3.22% | 1.65% | 4.76% | 15.02% |

| Emirates Islamic Global Balanced | 0.97% | -0.06% | 9.37% | 2.86% | 14.54% | 21.75% |

* Data is lagged by 1 day.

** Data is lagged by 2 days.